Double Tops and Bottoms

Double Top / Double Bottom

Double tops and bottoms are typically reversal patterns, signifying the trend may be coming to an end. The market is unable to make a new high or low when the price rallies a recent historical high/low, and subsequently fails. It is not an exact science, so the market may move slightly beyond the previous level before it fails, but the pattern should form a clear M’ or ‘W’ shape.

The example below shows a double top for AUDCAD in 2013. This was at the end of a major upward trend, as you can see the market completely reverses after forming a double top.

The same pattern can occur at the bottom of major moves as well. The key thing to look out for is a failed re-test of the high or low, with a clean bounce back in the middle. The market makes a new low, rallies, fails and holds around the same level as the previous low, then reverses.

The example below is for EURUSD in 2015. The double bottom signifies the end of the major trend.

The issue with trying to trade double tops and bottoms arises from the fact that these patterns do not always occur at the end of a major upward or downward trend. Sometimes these happen in the middle of the move, and signify the beginning of a temporary consolidation region.

Check out the example below, again for EURUSD this time in 2012. In this example, the market retraces after the double bottom, but fails to make a significant reversal. The sellers come back in and push the price to new lows and the trend continues.

How to trade double tops/bottoms

There is no holy grail to trading any pattern, what is important is that you trade with good money management and discipline. This means cutting your losses fast when the pattern doesn’t play out correctly.

It is important you only look for tops and bottoms where the market has formed this very specific pattern. This will increase your edge and avoid many false signals. Below is a strategy you can use to trade tops and bottoms.

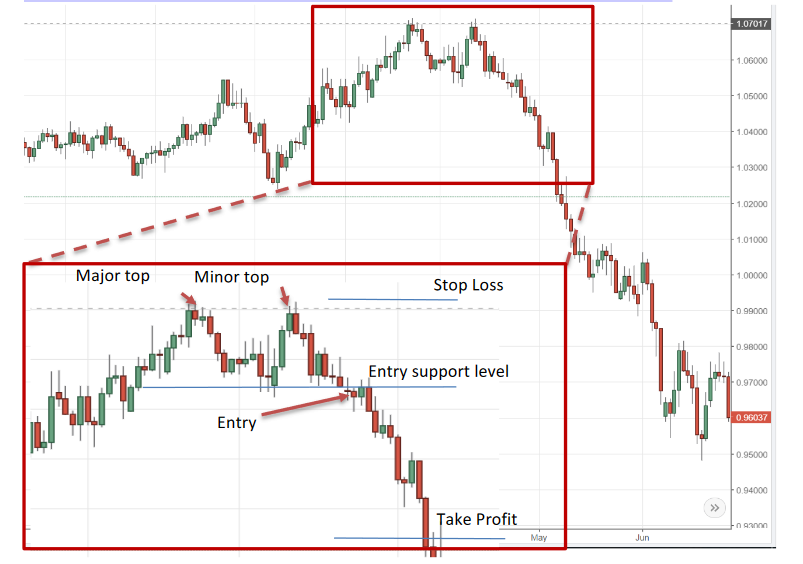

- Recognise the major trend in the market

- Wait for the major top/bottom to form

- Wait for the price to test a support/resistance level, and then fail to exceed the price of the major top/bottom

- After the minor top/bottom, wait for the price to close below the previous support level

- Enter a buy/sell in the direction of the new trend (sell for double tops, buy for double bottoms) with a stop loss above/below the double top/bottom

- Take profit based on your chosen exit strategy. See exit strategy guide.

Trading this for the AUDCAD 2013 example above would have resulted in profit.

Alternatively, if you are already in a position, a double top or bottom can be used as a good exit signal for a trade. If you were already in a buy position leading up to the major double top in the example above, you could close your position on the break below the support level.