Spreads and Pips

You might have already heard people talking about spreads and pips, but what do these terms mean?

What are spreads?

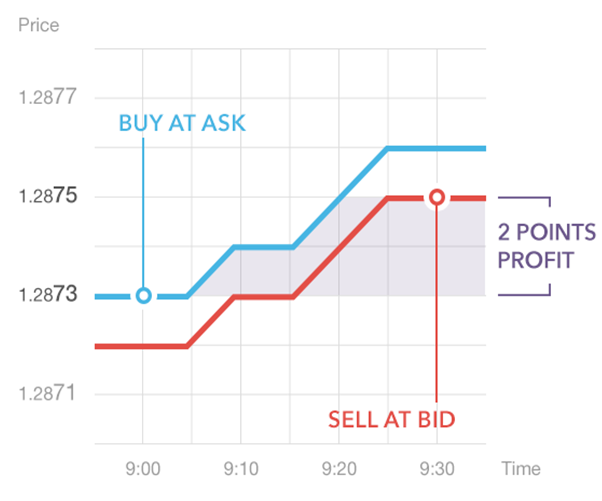

Spreads are the difference between the Buy and the Sell prices, also known as Ask and Bid prices. In the diagram below you can see this shown in practice. The difference between the blue and red lines is the spread.

The spread is how the broker makes money. When you buy a position you buy at the ask price, and when you close out that position you sell at the bid price. The value of the difference at that time is what goes to the broker.

Spreads change all the time with liquidity and volume of the market. Markets with more money in them have lower spreads, like the major Forex pairs (GBP/USD, EURGBP, etc.). Markets with less money have higher spreads, like the minor Forex pairs (NZDUSD, GBPCAD, etc.).

What are Pips?

Pip stands for “Percentage In Point”. This is simply a unit of measure for price movements. It helps to compare and visualise profits in a standard way across all markets.

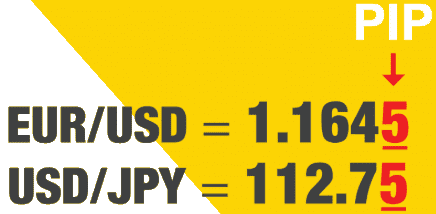

See the picture below. In the case of main Forex pairs, they are shown to 4 decimal places. The final decimal place is 1 pip. For JPY pairs, they are shown to just 2 decimal places and again the final decimal place is 1 pip.

For example: A market moves from 1.1000 to 1.1400. This is a move of 400 pips, because 0.0001 is one pip.

A lot of Forex trading sites and adverts will talk about pips. We don’t, because we prefer to focus on the measure of Risk to Reward (RR). The number of pips gained or lost on a trade doesn’t compare to the risk, whereas RR does this. We’ll talk more about RR in later parts of the course.