Welcome to the Analysis Room

In-depth Technical Analysis for Forex, Indices, Commodities and Cryptocurrencies!

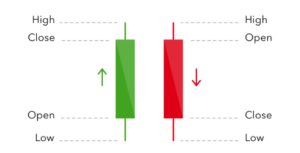

Price action trading GOLD

Mastering Price Action Trading on Gold: A Comprehensive Guide In the fast-paced world of financial markets, trading gold has always been a symbol of stability and a safe haven for investors. However, achieving success in trading gold isn’t just about luck; it requires a deep understanding of market dynamics, economic factors, and most importantly, price action. In this comprehensive guide, we will delve into the world of price action trading on gold, exploring key strategies, techniques, and valuable insights that can help you become a successful gold trader. Start Trading Gold HERE Section 1: Understanding Price Action Trading Price action

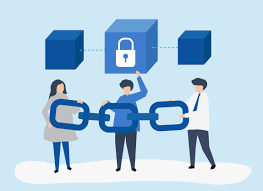

Keeping Your Cryptos Safe

When you own BTC, ETH, or DOGE, what you really own is a private key… Anyone with access to this private key will have full control over your assets. What this means is that no one – no bank, no regulator, not even mom – can stop a thief spending all your hard earned DOGE. Once it’s gone, it’s gone. Understandably, cryptocurrencies and blockchain can be quite daunting for beginners. But this is not an excuse to be lazy with our money. Security is not to be overlooked and must be on the top of everyone’s list, whether you happen

Trade analysis 28/1/2021

Let’s take a look at a couple of trades I took today and why! GBP has been looking fairly strong of late, offering a nice solid risk to reward!

A Look at the Crypto-asset Market

All markets move in cycles and the crypto-asset market is no different. Indeed, each market has its own ‘personality’ with varying degrees of volatility, seasonal tendencies, correlations, cycle durations and what not. So this article will give a quick overview of the crypto-asset market for investors looking to participate in the upside. To start off, let us have a look at the brief history of the market to understand where we find ourselves today. Everyone remembers when BTC reached $20K in December 2017. It was a moment of absolute euphoria as Bitcoin introduced itself to the world, moving away from

The Two Traders announce contract with University of Bath

We are excited to announce that we are working with the University of Bath Faculty of Humanities and Social Sciences to provide our bespoke Trading Education Programme service package.

The Two Traders partners with Elite Tier Racing

I am really excited to announce our first partnership is with racing community and Esports team Elite Tier Racing (ETR). With 450 members, ETR champions fair racing and has the motto “Respect always places higher”. As we look to expand and grow the The Two Traders community we are exploring mutually beneficial partnerships with groups and institutions that share our core values of honesty, integrity and community. ETR host and partake in a range of events, primarily on Forza Motorsport on xbox or PC. These are open to all abilities, as long as you race clean and respect the other

5 Reasons why YOU should trade with Real money *

These are 5 reasons why you should trade with real money, instead of always using a demo account.

Price Action Trading

Price action trading at its best, a simple but effective way to enter the market.

What are Futures Contracts?

Rollovers and contract expiration are some of the most confusing terms for retail traders. So, what are they and do they affect your trading?

Is It A Good Time To Buy Oil?- Oil Hits 18 Year Low

We are in unprecedented times. Crude Oil has hit an 18 year low. What is driving this? Is it a good time to buy oil? Read on for my thoughts…

April Profit Week 1 Analysis

A nice start to April, here is the analysis for a couple of the trades. New traders should especially pay attention to the EURGBP trade as the market was pretty much perfect! If you have any question regarding technical analysis please get in touch.

Today’s Nasdaq US100 Trade

Watch the video for some technical analysis on the US100 trade we sent out in our community. This is a trade we did not profit from!

Natural Gas

One of our most experienced community members, Tom, gives us his insight on Natural Gas. Watch the video here!

Big Profit on GBPUSD – Trade Analysis

A successful trade on GBPUSD today, click here to watch the analysis video!

Bitcoin Market Watch 25/03/2020

Can Bitcoin break $7,000? It is refreshing to see financial markets across the board bounce back with some bullish price action since the crash two weeks ago. In the case of cryptocurrencies, the total market cap has recovered more than $40 billion – now sitting at $185 million – and is being led by Bitcoin, itself jumping to 67.4% market dominance. On the daily chart, BTC/USD has been gaining steadily over the past two weeks, supported by increasing volume and a bullish change in market structure. Price broke above the supply zone around the $5.6K – $5.8K level, found support

Understanding Volume

How volume affects the market at key decision levels. A good way to think of this…Imagine you’re driving a car, as you travel along the straight ( no support or resistance) we don’t need much fuel (volume) to cruise along. However, now we are approaching a hill (the resistance/support) If we continue without applying more pressure to the peddle and using more fuel (volume) we will stop and start to roll back down. If the car is expected to keep going up a steep hill, do you think gently pressing the gas pedal would do the job? The forward motion of

Oil Analysis

A market often highly discussed is Oil, I’ve participated in a few discussions recently with people who think it’s time to sell Oil. Here is my view and the reason why I’m currently bullish on Oil. The best way to learn how to trade is by getting a trading account set up and getting stuck in. Set up a trading account with Europe’s leading Broker, click HERE.

Market Watch

Here are some of the Forex and Commodity markets we are currently watching, potentially looking to find entries over the next few days. Coffee is at a low but will we see a reversal?, Nat gas is trying to reverse after hitting support, has GBPUSD reversed or have we just seen a pullback? and where next for EURGBP after it hit it’s lowest point in 2 years? Learn how to spot these patterns effectively… Start our market leading course today! Get a trading account set up and start practising today! Trading account!

Supply and Demand Zones

I’ve put together a short video showing you how we use supply and demand zones, if you’ve traded using support and resistance levels you’ll find supply and demand zones similar. Personally i find supply and demand zones better than support and resistance but used together can give you great results as shown in the video below….

Calculating Position Size

Calculating your risk! This is a subject i get a lot of questions on … If i want to risk 3% of my trading account how to i know how many ‘lots’ to buy or sell? I know how it important it is firstly to make sure you’re risking the correct amount of your total equity, but also Forex markets can move extremely fast so when you spot the pattern or breakout you’ve been waiting for every second counts. It couldn’t be simpler, with our broker your position size gets calculated automatically saving you vital time but also ensuring you

Diversifying your Investments in Simple Steps

Diversification is one of the most crucial elements to trading success, and simply put, it means don’t put all your eggs in one basket. Diversifying your investments enables you to draw on the fact that some markets will perform poorly, when elsewhere another market is doing well. You can draw on the strengths of different asset classes to give you much smoother growth. Why is diversification so important? Too many traders focus on one asset class or market and assume that the recent performance will continue indefinitely. This has been particularly true in the last couple of years. With interest

Where next for Bitcoin?

The question is, where next for Bitcoin? This is something I’ve been asked regularly over the past year, unfortunately it’s not an easy question to answer. No one has a crystal ball, it’s a matter of waiting for either a support or resistance level to break. When these levels are broken we tend to see large moves in Forex, Commodities as well as Crypto currencies. What tends to happen at support levels is we see bulls trying to push the price higher whilst the bears are trying to sell the break out and push the price lower triggering stop losses

Why Win Percentages Are Irrelevant

How Can You Lose Money Trading Forex Winning 80-90% of Your Trades? As a new trader you may be thinking winning all your trades is important, it can be difficult to understand why winning 80-90% of your trades isn’t important especially with a lot of companies claiming these success rates. The sooner you come to realise that losing trades is part of the game the better! In fact, losing 50% of your trades is normal and we will go on to talk about this later on. Winning and Being Right! Winning and being right are things we associate with people

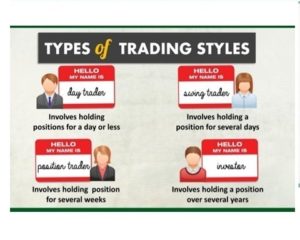

How To Trade Forex In Simple Steps

Why trade Forex? Not only is Forex trading exciting but it’s extremely educational, in fact you’ll never stop learning. The first thing you’ll need to do when learning how to trade Forex is work out what style of trading would suit you best, see our previous blog outlining different styles of trading. The next step is to find a reputable broker Finding a good broker is extremely important! If you’re new to Forex trading you won’t realise how important it is to find a broker with tight spreads. This can sometimes mean the difference between profit and loss. We’ve done

What Type of Trading Is Best For You?

What type of trading is best for you? So the first question you need to ask yourself before you start trading Forex is ‘What type of trading would suit me best? ‘Naturally, your Forex trading system needs to factor in how much time you can dedicate. Lets look at the different types of trading and what they require….. Scalping: Scalping is the fastest type of trading, positions are held from a few seconds to a few minutes. Scalpers aim to get a small amount of pips per trade countless times throughout the day. This style requires you to be glued to

How To Trade The Forex Markets In Both Directions?

You probably understand what “Buying” or “going long” on a financial instrument means, but do you know how to trade the forex markets in both directions? Read on to discover what it means to “go short” when trading. “Shorting” or “going short” are popular terms in trading, but shorting requires an explanation to be understood properly. To understand going short, you must first understand what it means to go long. Buying or “going long” is the exchange of money for another financial instrument, in order to make a profit by selling it back for a higher price at some point

Why You Should Buy At All Time Highs

Why do markets rally further after breaking to all-time-highs? People find it strange that I buy a market when it breaks to extreme ranges and to all-time-highs. In fact, this is probably my favourite and most profitable pattern to play. When everyone is thinking ‘surely this can’t go any higher’, I’m stepping in to buy.

Trading Top Tip: Cut Losses Early

This is my number one rule when it comes to trading – cut your losses early. When it comes to trading, managing your risk is the most crucial element to future success. This means knowing when you’re wrong and doing something about it.

$11,000 in 48 hours & what next for USD?

Last week saw USD plummet significantly to fresh 3 year lows. Thanks to some INSANE moves, I was able to make just over $11,000 in less than 48 hours thanks to USD short positions I sent out to all the Forex signals subscribers. So the big question is, where does USD go from here? Watch Now

The Big Week Ahead: JPY, EUR, USD and GBP

It was a very volatile end to the week last week, with all the major currencies pushing through significant support and resistance levels. The US Dollar has collapsed to 3 year lows, the Euro is at 3 year highs, and the pound is approaching Pre-Brexit levels. So where do the markets go from here? Learn how to trade these patterns effectively Start our market leading Forex course today. Watch Now

The Power of Compounding Growth

One of the biggest hurdles that new traders face is access to capital. As such, one of the questions most asked is how much people will need to start with to make a lot of money. The reality is that a small amount of capital can be turned in to a very large amount of money through the effect of compounding growth. This means that as your account grows, your position size grows with it. This requires you to reinvest your profits. Investing in yourself is one of the key traits of successful people. Too many people are quick to

A $6,000 Lesson From Ripple

Lessons From A Loser As I regularly mention, I often feel there is more to be learnt from a losing trade than a winning one. You WILL have losing trades. It’s all part of the game, and so you need to get used to. Those of you who were in the group a few weeks ago will remember this Ripple long I signaled just after it broke to all time highs. For those new to the group here’s a brief recap.

5 Reasons Why Learning To Trade Will Be Your Best Decision Ever

I first got involved in trading during the summer of 2013. I was convinced I didn’t want to spend the rest of my life in an office working for someone else’s dream, but hadn’t yet figured out how I’d make my own way. Throughout most of my teenage years I was an avid poker player, but realised I didn’t have the patience to spend long hours alone playing online tables to build up a bank roll. This is when I first got introduced to trading by a chance ad online – it changed my life so significantly that I moved

Crazy Cryptos & Catching Copper! Plus a New Space for Traders!

As we approach the Christmas period, I am up nearly 20% for the month! This puts me in profit for 7 out of the last 8 months, with 4 of those at nearly 20% or higher. There have been some great moves this month, and there are more on the horizon. As we enter the new year, I have also made the Chatroom feature available for traders to share analysis and learn new ideas! Watch my latest video update for analysis on the latest big crypto moves, but why you should learn to trade other markets.

Metals are down, Crypto at all time highs &GBP Critical Levels

Watch my latest video to find out which Forex markets to watch this week. Metals have been falling for weeks, cryptos are at all time highs, and GBP is approaching critical levels. (Apologies for the echo in the video, the villa I’m in at the moment has bad acoustics!) Start our Forex trading course here.

Trading Top Tip: Understand How To Use Margin & Leverage

These two characteristics of trading enable you to utilise your equity to its maximum. Without these, it would be near impossible to make decent returns without a huge starting bankroll. However, they are often poorly understood by traders, with disastrous consequences. Let’s start by defining the two concepts

My biggest day EVER! $5,000 in 24 hours

Friday saw my biggest profit ever, as cryptos rose sharply across the board. My longs on Ethereum, Bitcoin, Bitcoin Cash and Litecoin that I signalled over the last few weeks saw a profit of nearly $4000 over the day. On top of this, my Forex and Commodity trades all pushed in the right direction for another $1000. To get started set up your trading account HERE. Learn to trade here, start for FREE! Watch the video below for full analysis on cryptos and where I think they are heading this week:

Trading Top Tip – Always Use A Stop Loss

Trading without a stop loss is like catching a train without a ticket. 9 times out of 10 you feel might make a small gain, but the 10th time when you get caught you pay a hefty price. Going in to a position without knowing where you’ll cut your losses ventures out of trading territory and in to the gambling zone. No-one is right on 100% of their trades, so how can you not have a plan for the occasions you are wrong (And you will be wrong often)?

Crypto moves to watch this week

Check out the latest market watchlist and which crypto moves I think have most potential in the coming weeks. Markets to watch include $Bitcoin, $Ethereum, and $Bitcoincash Watch

5 Benefits of a Trading Community

When you first start to trade, you can quickly become lost. Whether you know it or not, you have no idea which challenges lay ahead, and how could you? I blew my account several times over when I first began, because I had no one to guide me and as a consequence I kept making mistakes. It isn’t easy to know where you are going wrong, and it’s even more difficult to know the solution. This confusing, frustrating phase of trading is where most new traders remain. They remain lost, and they ultimately do not make any money.

Trading Top Tip: Learn Before You Earn

A mistake most novices make is to try and jump straight in to the market, with no real idea what they are doing. I know, because I did exactly this. They inevitably wind up losing money, and most give up and join the rest of the 99% of people who lose money to the markets.

Which Type Of Trader Are You?

The amount of time a financial instrument is held by a trader defines their style of trading. The type of trader you are, or choose to be, will be highly dependent on your personality. Do you prefer to have complete oversight over your work, investing the greater part of your day into perfecting your projects? Or are you like myself at The Two Traders, happy to invest effort into shorter periods of time for maximum output, making it possible to pursue many goals at once?

The Formula For Making Millions

Trading is often seen as a field that is associated with an extremely niche skillset. In 1983, legendary traders Richard Dennis and William Eckhardt conducted what later became known as ‘The Turtle Experiment’ after Dennis turned an initial stake of less than $5,000 into more than $100 million. The hypothesis was simple: they wanted to prove that anyone could be taught to trade, so Dennis found a group of people who after two weeks of studying his rules were made to trade with real money. The result? The two classes Dennis personally trained earned more than $175 million in only

Portfolio Update and Markets to watch this week!

The most recent portfolio update is out, after making around $1500 last week. The biggest trades were $Soybeans, $Cocoa, NZDUSD and $BTC Also find out which markets I am looking at closed this week, such as $EURCHF, and $Natgas. If you don’t have access to all these markets, you can get set up here to make sure you don’t miss a trade.

Portfolio Update: 10/10/2017

The portfolio has been mixed across the week and remains at a drawdown of around 14% from all-time account highs. Natural gas has lead the way as the biggest winner, finishing up at a total of around $2000 profit including $500 in rebates. I have closed most of my exposure on this and will be looking to close the rest out soon.

5 Habits of Successful People

Being successful isn’t a walk in the park. I’m not the most successful trader out there, but I have managed to achieve a lot in a short period of time. At 18 I started trading whilst at University. By 21 I was managing $300,000 of investors’ money. By 23 I have a track record that beats that of most hedge funds, I trade for private investors, and I have my own business whilst travelling around the world.

Removing the human factor with systems trading

Almost every career is at a threat of having people replaced by machines. I know this was one of my main worries whilst at university; studying a degree steeped in logic, how long was it before the human error I was capable of made what I learned redundant by a machine that could do it better? AI and humanity do not need to be mutually exclusive, especially in trading. What gets most traders is the inability to separate ‘gut feeling’ and subjective opinion from their trading decisions, sometimes with disastrous results.

Portfolio Update & September Round-up

In the last couple of weeks the portfolio has pulled back from all-time-highs and September finished down -3%, after initially being up 10%. Drawdowns are the most frustrating and difficult part about trading, as it is much more difficult to watch hard earned profits disappear than it is to watch your equity grow. This where good money management and trading psychology come in to play (If you haven’t already, watch the videos on these here). Start our trading course today.

How to use margin and leverage

This blog is going to talk about one of the topics I receive more questions on than anything else: leverage and margin. More specifically, how these two characteristics of trading can enable you to utilise your equity to its maximum, whilst understanding the potential downsides and risks.

Portfolio Update: +$3000 Profit week, from 15 minutes a day!

Finishing up the week with just under $3000 profit, from 15 minutes of trading a day. (I’ll take a $3000/hr payoff) Our biggest winners are $NATGAS (+$700), $EURJPY (+$650) and $GBPCHF (+$654)

What comes after Cryptos?

Now before I begin, I would like to make it clear that this is not a doom and gloom ‘crypto currencies are a bubble’ article – although the possibility will be mentioned. I am more aiming to ask a question that everybody seems to be avoiding – what will be people do when these extraordinary market conditions end?

Portfolio Update 19/09/2017

Here with the latest portfolio update, focusing primarily on $USDCAD, $GBJPY, & $EURGBP. Profit in last 7 days is at $2100, and all 7 positions except $USDCAD are at profit.

3 Characteristics of Winning Traders – Traits you must develop

There are certain character traits that are crucial to your success as a trader – Luckily, these can all be learnt at any time. Some people believe that you have to be super-intelligent, good with numbers, and that people are ‘natural-born traders’. This is simply wrong. This was conclusively shown to be false by the same story that inspired me – Richard Dennis’s ‘turtle’ experiment, where he took 14 non-traders and taught them how to trade in only 2 weeks. They went on to make $175 million in only 5 years. I deconstruct and explain all the same principles in

3 Characteristics of Losing Traders – Spotting your Bad Habits

Being a profitable trader is an achievement so many aspire for and yet so few are able to realise. Even with a profitable strategy, a few bad habits can destroy any chances of success. When I first started I made every mistake in the book, which I am very open about when I discuss my story. What separates me from most others is that I learnt from my mistakes and persevered through. Here I discuss what I believe are the 3 key hurdles to avoid, not only in trading, but in life.

GBP – How much higher can it go?

The pound rallied significantly last week against all the major pairs, and is up over 5% in September. This raises the question, with so much uncertainty still remaining around Brexit, how much further can this go? The pound has been everyone’s favourite currency to short for nearly 2 years now, so we may have finally run out of sellers and be ready for a short squeeze. We are currently around 1 year highs, at levels not seen since the day of the Brexit vote which will be a significant psychological barrier but, if broken, opens up significant upside.